When I worked at Marine Credit Union as a business analyst, I was also a product manager for checking accounts, which included online banking, their mobile app, ACH, and debit cards. I was also responsible for the company’s CRM system (before I helped to migrate the company to Salesforce’s CRM system).

During my time at the credit union I made several key product improvements to checking products:

- Synergy Check Image Sync

- New, Online Loan Payments

- ACH Rule Automation

- New Overdraft Protection Software

- Automated Error Reporting

- Loan Payments in Mobile App

Synergy Check Image Sync

I created a system that linked check images from the item processing system into the core software, making it easy for employees to look up check images (rather than doing manual searches), which saved time and helped customers.

New, Online Loan Payments

I added the ability for loan borrowers to make one-time loan payments online and by phone. Prior to this, they could only pay via mail or in person at a branch.

ACH Rule Automation

I helped get a module built for our core processing software that automated business rules for ACH transactions, eliminating all but the outliers, which saved the ACH department in Deposit Operations 10s of hours a week.

New Overdraft Protection Software

I launched a new overdraft protection software to increase revenue and decrease risk. Instead of giving everyone a flat amount, it was calculated.

Automated Error Reporting

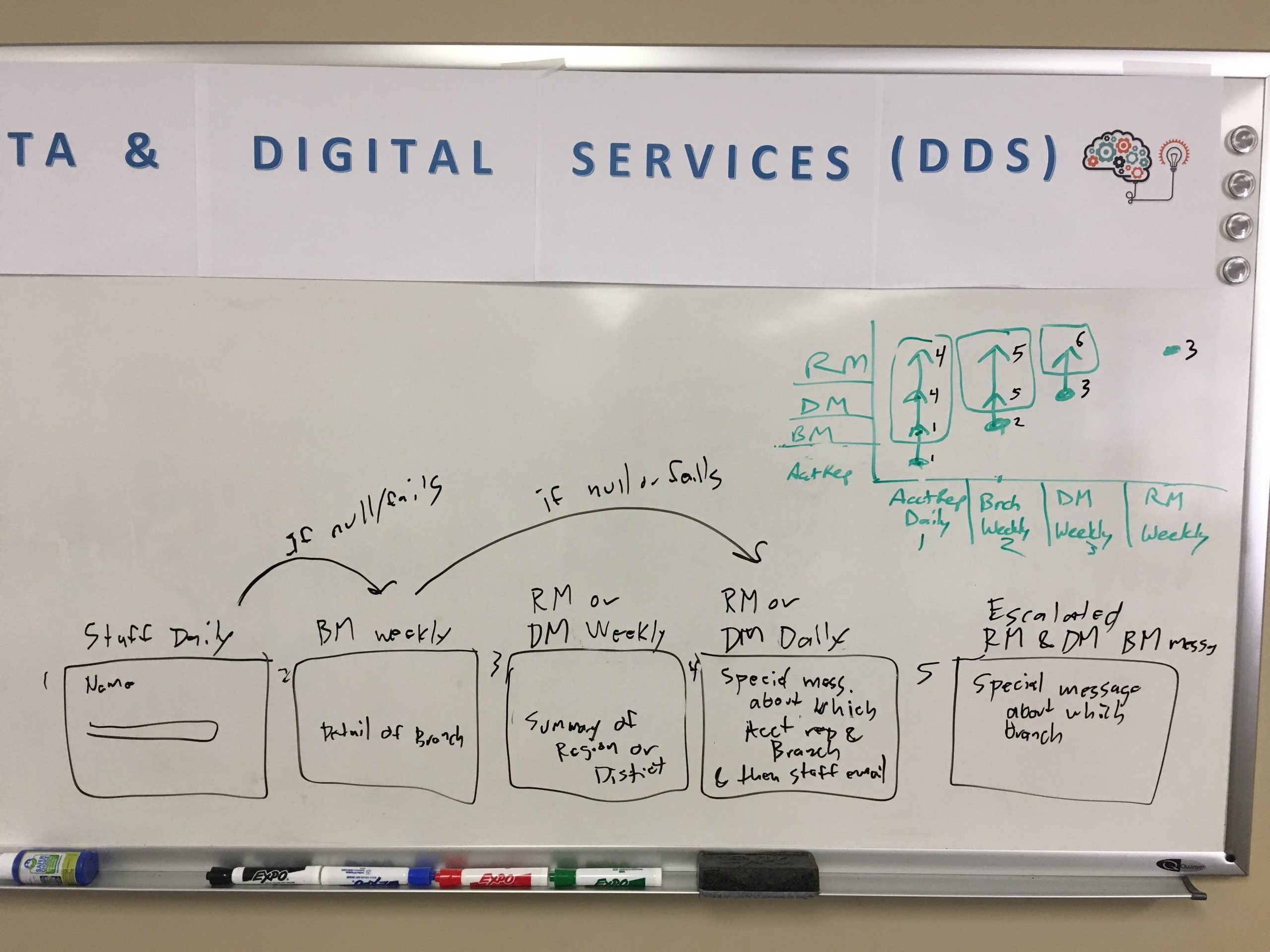

And in addition to working with data analysts to create many different, new reports, I also created a system to automatically email branch, regional, and district managers in escalation when exceptions with new accounts were not resolved in a timely manner. This automation saved hours of manual intervention.

Loan Payments in Mobile App

And finally, I added the ability for customers to make loan payments from within their mobile app using a web page managed from the corporate website.